St Charles County House Buyers Share the Top Myths New Buyers Still Believe

St Charles County House Buyers Share the Top Myths New Buyers Still Believe

Blog Article

What Every First-Time Real Estate Customer Demands to Know Before Purchasing

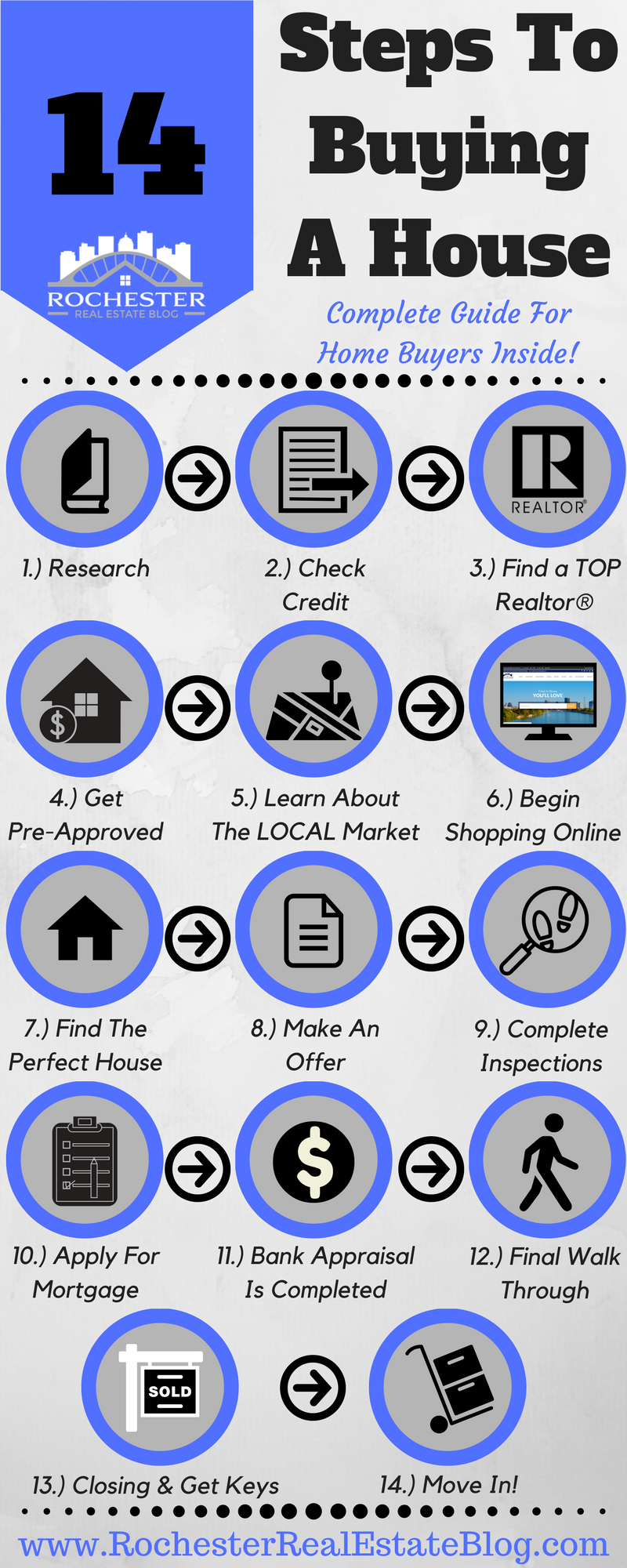

As a new realty customer, it's crucial to understand the monetary landscape before diving in. Understanding your budget plan, funding choices, and the neighborhood market can make a significant difference in your experience. You'll would like to know what to anticipate during the home inspection and just how to navigate arrangements successfully. But there's even more to contemplate that might influence your trip. Allow's discover what you need to recognize to make educated decisions.

Recognizing Your Budget and Funding Options

Just how can you ensure you're making an audio economic choice when acquiring your very first home? Beginning by recognizing your spending plan and financing choices.

Following, explore funding options. Consider different sorts of lendings, like FHA or traditional home loans, and compare rates of interest from various lenders. Don't fail to remember to consider the down payment; a bigger deposit can decrease your monthly payments and total passion.

Lastly, get pre-approved for a mortgage. This provides you a clear photo of your loaning power and enhances your position as a customer. By taking these actions, you'll identify you're monetarily prepared to make this substantial financial investment.

Investigating the Local Real Estate Market

When you're prepared to purchase, comprehending the local genuine estate market is vital (St Charles County House Buyers). You'll intend to evaluate market patterns and contrast rates throughout communities to make educated choices. This study can help you find the appropriate home at the ideal cost

Assess Market Trends

Recognizing market trends is essential for novice property buyers, as it aids you make informed decisions. Beginning by looking into neighborhood residential property values, ordinary days on the marketplace, and the quantity of sales. Focus on whether the marketplace is trending upwards or downward, as this can impact your acquiring approach. Look at seasonal patterns; some markets might have peak buying seasons where prices boost. Additionally, think about financial variables like task growth and passion rates, which can influence need. Use on the internet resources, attend open residences, and consult regional actual estate representatives to obtain understandings. By examining these fads, you'll be much better outfitted to determine the correct time to buy and work out efficiently.

Contrast Neighborhood Costs

As you plunge into the regional realty market, contrasting area prices can disclose useful understandings that help you find the ideal home. Start by looking into current sales in numerous communities and keeping in mind the average rate per square foot. This information highlights which areas are extra budget-friendly and which ones are trending upward. Take note of home types, as rates can vary substantially between single-family homes, condominiums, and townhouses. Do not forget to consider regional facilities, schools, and overall neighborhood value, as these can impact rates. Use on-line actual estate systems and seek advice from local agents to gather comprehensive info. By comprehending area price variants, you'll make a more educated decision and protect a home that fits your budget plan and lifestyle.

The Importance of Obtaining Pre-Approved for a Home Loan

Getting pre-approved for a mortgage is vital, particularly if you wish to stand apart in a competitive property market. When you're pre-approved, you recognize exactly how much you can obtain, providing you a clear budget plan to collaborate with. This not just streamlines your home search however likewise reveals vendors you're significant and monetarily capable.

Additionally, a pre-approval assists you recognize any possible concerns with your credit history or finances early, allowing you to resolve them before you start making deals. Oftentimes, vendors like purchasers who are pre-approved, as it lowers the threat of funding failing later on.

Last but not least, being pre-approved can accelerate the acquiring procedure (St Charles County House Buyers). With your funding currently lined up, you can move promptly when you discover the best residential or commercial property, increasing your chances of securing your desire home without unnecessary delays. So, take that essential step prior to diving right into your home search!

Recognizing Your Must-Haves and Deal-Breakers

As a novice buyer, it's crucial to recognize your must-haves and deal-breakers early while doing so. Assume about the necessary features that will certainly make a home seem like home and the non-negotiable variables that could derail your purchase. This quality will help you limit your options and make more enlightened choices.

Define Crucial Functions

When you set out to get your initial home, defining your crucial functions is essential to making the ideal option. Consider your future requirements, as well; will your family members expand? This quality will certainly assist you make educated decisions and locate a home that really fits your needs.

Recognize Non-Negotiable Elements

While looking for your first home, recognizing non-negotiable elements is vital to limiting your options successfully. Beginning by recognizing your must-haves, such as the variety of rooms, proximity to function or institutions, and outdoor area. Consider way of living demands, also-- if you're a serious chef, a contemporary cooking area might be a concern.

Next, determine your deal-breakers. These could include buildings that require extensive fixings or areas with high criminal offense prices. Be truthful with yourself concerning what you can't endanger on; it'll conserve you time and frustration.

The Home Examination Process: What to Anticipate

A home inspection is a necessary step in the buying procedure, giving you a comprehensive appearance at the home's problem. Throughout the evaluation, a qualified assessor evaluates crucial facets like the roofing system, pipes, electric systems, and foundation. You'll desire to be present, so you can ask questions and acquire insights into any issues.

Expect the assessment to take a few hours, relying on the property size. Later, you'll receive a comprehensive record describing the searchings for. This document will certainly highlight areas needing repair work or upkeep, assisting you make educated decisions.

Bear in mind that no home is perfect-- some concerns are minor, while others may be significant. It's vital to recognize the effects of the record, as this information will certainly lead your following steps. Trust your instincts, and don't wait to seek advice from with your property representative concerning the searchings for. A detailed examination can save you from costly shocks later on.

Browsing Arrangements and Making an Offer

Guiding negotiations and making a deal can really feel daunting, yet with the right approach, you can protect the home you desire. Beginning by looking into equivalent sales in the area to determine a fair deal cost. This provides you leverage during settlements. When you prepare to make an offer, be clear and concise in your communication.

Maintain your contingencies in mind, like funding and inspection, as these shield you. Remain calm and expert throughout the process. Bear in mind, it's an organization transaction, and preserving a favorable connection can assist you secure the very best offer feasible.

Closing the Deal: Last Actions to Homeownership

Closing the offer on your new home includes several essential steps that can appear frustrating. You'll need to finalize your home mortgage approval, making sure all financial records are in order. When that's done, it's time to set up a home assessment. This step helps identify potential concerns prior to you devote.

Following, review the closing disclosure thoroughly; it outlines your finance terms and shutting costs. Don't wait to ask questions if anything's unclear. After that, collect your funds for shutting day, which typically includes the deposit and extra costs.

On closing day, you'll meet the seller, your representative, and perhaps a closing attorney. You'll sign numerous records to formally move ownership. Nevertheless signatures remain in place, you'll receive the tricks to your brand-new home. Congratulations! You're currently a property owner, ready to make lasting memories in your new space.

Regularly Asked Inquiries

What Are the Hidden Costs of Buying a Home?

Exactly how Long Does the Home Acquiring Process Usually Take?

The home acquiring procedure generally takes a couple of months, however it can differ. You'll require time for study, securing financing, home searching, examinations, and closing. Persistence is crucial to ensuring you make the right choice.

Can I Purchase a Home With Bad Credit Report?

Yes, you can acquire a home with poor credit, but it might limit your options. Take into consideration functioning on enhancing your credit report first, or explore government programs made to help customers with reduced credit rating scores.

Should I Consider an Actual Estate Agent or Go Solo?

You must certainly consider a property representative. They'll guide you through the process, negotiate on your part, and aid you stay clear of expensive errors. Going solo may save money, yet it can see this site also lead to issues.

What Happens if I Adjustment My Mind After Making a Deal?

If you transform your mind after making a deal, you'll normally shed your down payment deposit. It's necessary to recognize your agreement's terms and consult your representative to check out any type of possible consequences or options.

Report this page